How Home Builders Qualify for Tax Incentives Through the Inflation Reduction Act of 2022

One of the main goals of the recently enacted Inflation Reduction Act of 2022 (IRA) is to reduce carbon emissions by 40% for residential structures by the year 2030. In order to accomplish this ambitious agenda, the legislation extends the Energy Efficient Home Credit (Section 45L) through 2032. This program offers federal tax credits to eligible contractors for single family homes, manufactured homes and multifamily structures placed in service between 2023 and 2032.

What does that mean for builders?

Up to $2,500 credit per dwelling that meets or exceeds ENERGY STAR® requirements

Up to $5,000 credit per dwelling that meets or exceeds Department of Energy’s Zero-Energy Ready Home (ZERH)

Multifamily projects of more than three stories are eligible

Low Income Housing Tax Credit (LIHTC) can be used concurrently where applicable

Partners like DuPont Performance Building Solutions can help builders and contractors ensure their home projects meet criteria through the building envelope while helping their customers enjoy a more efficient home. Let’s explore how.

Achieving IRA Compliance with Building Envelope Solutions

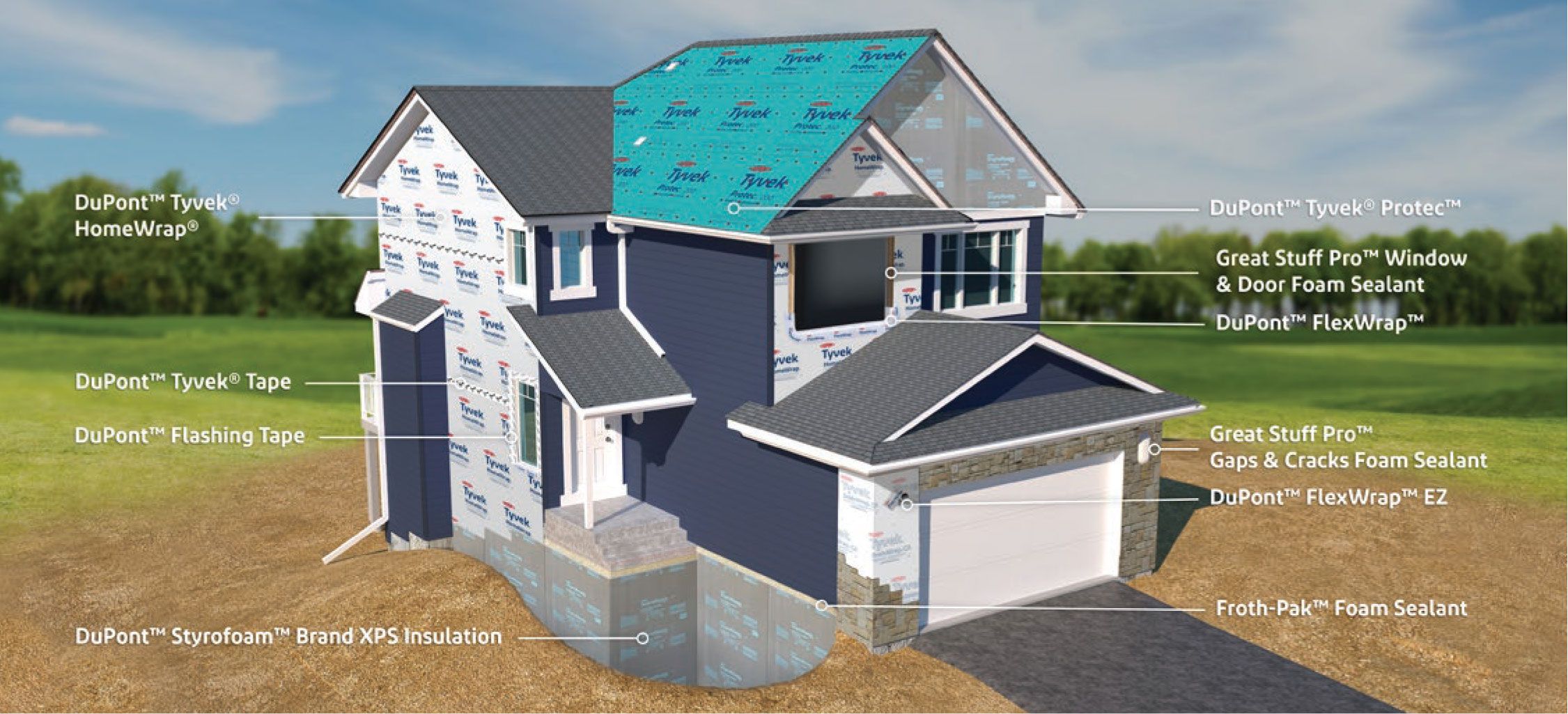

Fundamental to meeting the IRA requirements for energy efficiency are the control layers of the building envelope. DuPont products are designed to work together to meet or exceed standards, enabling homeowners to obtain the tax credit. Eligible materials include DuPont™ Tyvek® Weatherization Systems, DuPont™ Styrofoam™ Brand XPS Insulation, Froth-Pak™ and Great Stuff Pro™ Foam Sealants, and more.

It’s important to note that envelope requirements depend on whether the home is single- or multi-family, and applicable versions of ENERGY STAR® and Department of Energy ZERH vary by location. Once the structure is compliant, contractors should use IRS Form 8908 to file for the credit.

Multiple Benefits Across the Board

With inflation that’s predicted to remain relatively high in the near term, these updated incentives to builders are especially useful.

Not only do the tax incentives provide an obvious financial benefit to builders, those buildings will also be more attractive to home purchasers who may be influenced by forecasted energy costs. With the prices of homeownership soaring, every dollar counts, and buyers are weighing their options carefully to ensure they will be able to pay their bills with estimates that electricity costs will keep rising for the foreseeable future.

There’s also the added attraction for homebuyers who want to feel they’re doing their part for the environment by purchasing an energy-efficient home.

Your reputation will benefit if you create homes with excellent building envelope design. Not only does this provide savings in energy costs, it ensures the home is comfortable and resistant to damage from the elements.

Energy efficiency strategies are here to stay, and with tax incentives now in place for at least the next decade, it’s time to take advantage of these opportunities in the single- and multi-family housing sectors. DuPont products are designed to address energy efficiency and will help you achieve IRA standards. Learn more here.

Commercial builder? Learn more about the Tax Deduction for Energy Efficient Commercial Buildings (Section 179D)

Homeowner or renter? View our Manufacturer’s Certification Statement for the Energy Efficient Home Improvement Credit (Section 25C)

Keep learning. Keep building better.

Register for updates from the DuPont Performance Building Solutions EDU HUB and we'll keep you current on the latest building insights and training opportunities that will help you to do your best work for your customers.