-

All

-

Featured Solutions

-

Viewpoints

-

Knowledge

-

Industry Engagement

Featured Solutions

How DuPont Is Accelerating Optical Industry Innovation at its Taoyuan Site in Taiwan

In this video, Joyce Yeh, regional sales manager for silicones, discusses DuPont's enhanced and expanded Optical Silicone Lab in Taoyuan, Taiwan.

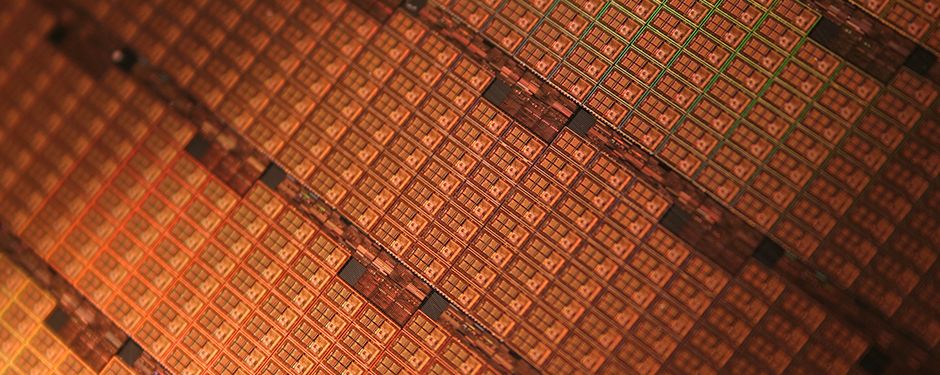

The materials science backbone of AI: Challenges and opportunities

Amid the breathless speculation about their mind-boggling possibilities, advanced computing and artificial intelligence applications face consequential but little-publicized performance hurdles.

The biggest threat to electric vehicles – and the materials solution

Thermal runaway is a critical safety issue in electric vehicles, occurring when a battery cell experiences an uncontrollable temperature increase. Flaws in or damage to a battery can spike heat within the battery.

Advancements in Thermal Management: Material Talk With DuPont

An insightful discussion featuring Mike Kwasny, business development manager at DuPont™, delves into technologies and innovations in electronics manufacturing featuring their unique material solutions, including their Kapton® film and Pyralux® laminate lines.

Why Select DuPont™ Kapton® Films?

For more than five decades, DuPont has been at the forefront of material science, driving innovation and technological advancement with materials that have become synonymous with high-performance, reliability, and versatility.

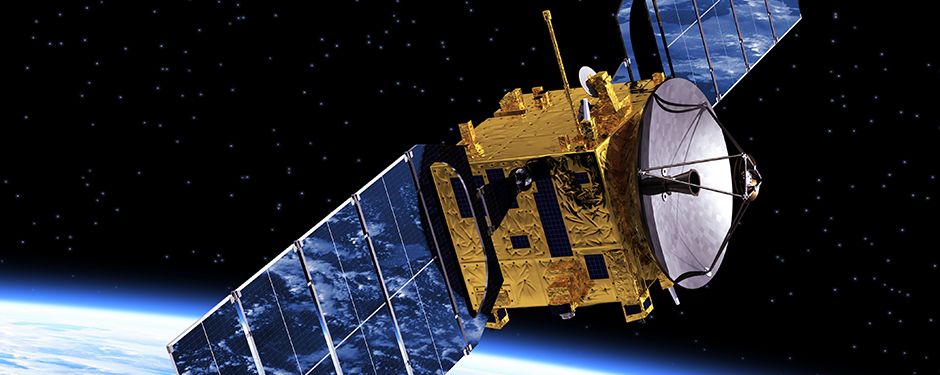

Protecting Space Exploration Vehicles and Satellites

Protection of Rover’s sophisticated equipment is crucial to the overall success of the mission.

ESA Mission to Explore Jupiter’s Moons Features DuPont Technology

Kapton® protects Jupiter Icy Moons Explorer by providing thermal insulation against extreme temperatures encountered during the mission.

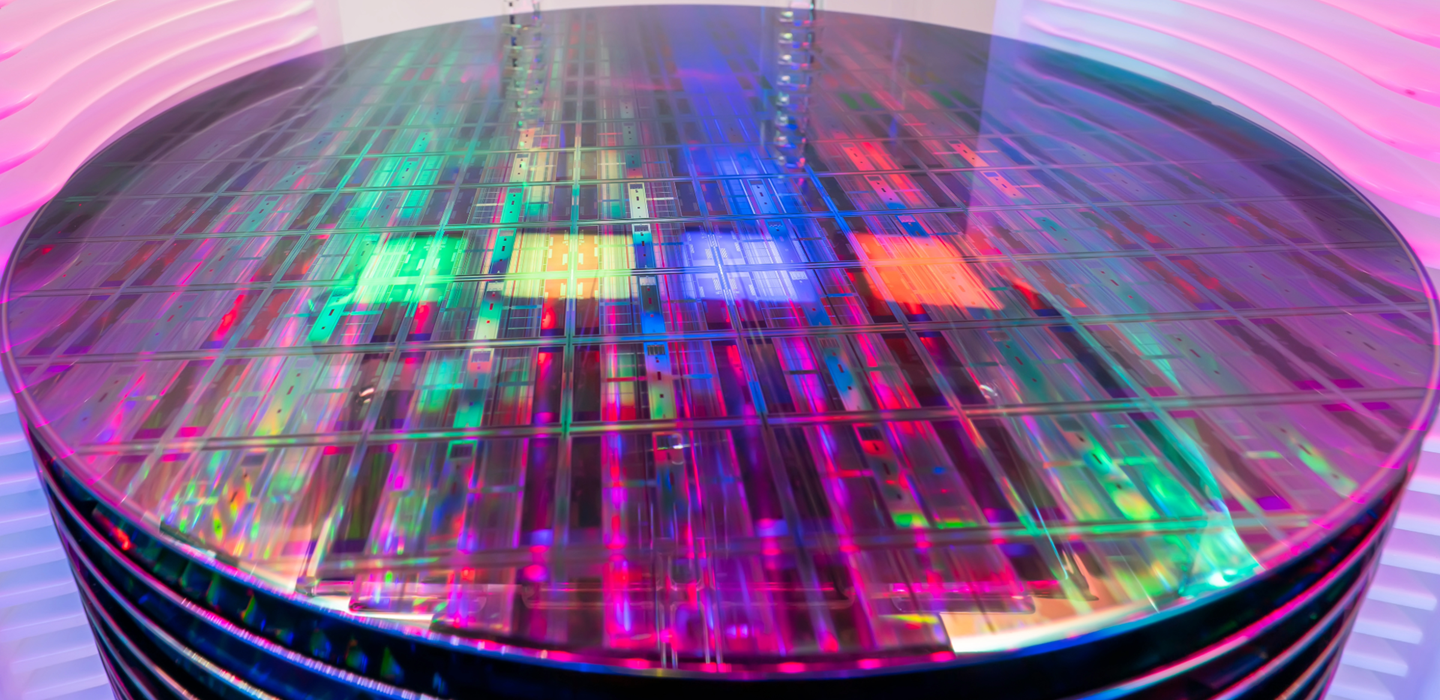

Helping Advance DuPont’s Sustainability Commitment: PCMPSolv™ Cleaning Solutions

DuPont PCMPSolv™ family performs advanced post-CMP cleaning with safer-by-design, green chemistries.

DuPont Pyralux® AP to Aid Reliable Performance of Semikron-Danfoss eMPack® Modules Powering Next-Gen Electric Vehicles

DuPont (NYSE:DD) Interconnect Solutions, part of the Electronics & Industrial business, announced today a multiyear contract with European power module manufacturer Semikron-Danfoss

New digital hub features DuPont’s total solutions for advanced automotive interconnects

DuPont (NYSE:DD) Interconnect Solutions, part of the Electronics & Industrial business, announced today a multiyear contract with European power module manufacturer Semikron-Danfoss who will integrate DuPont™ Pyralux® AP all-polyimide double-sided copper clad laminate into its eMPack® power modules to further enhance the capabilities of next-gen electric vehicles.

Kapton® Returns to the Moon

On November 16th, NASA successfully debuted its Space Launch System (SLS) rocket and the Orion capsule with a long-awaited launch from Kennedy Space Center, for what will be a more than month-long journey around the Moon.And as was the case for the first missions to the Moon, DuPont™ Kapton® polyimide films are onboard.

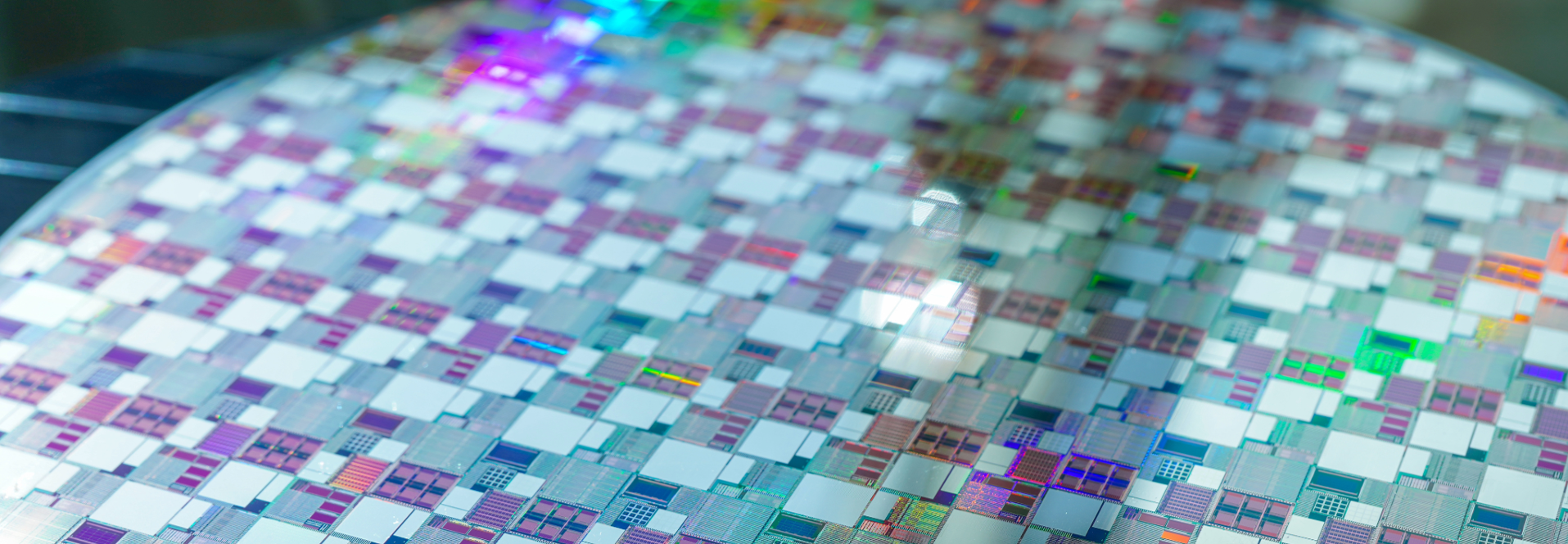

Fine-Line Patterning for SLPs Calls for High-Resolution Photoresist

Product miniaturization is driving demand for substrate-like PCBs (SLPs) with finer patterns, requiring advanced photoresist materials.

Thin Laminates as Embedded Capacitance for PDN Designs

Power distribution networks provide clean power for electronics. Using thin laminates for capacitance enables lighter end products with low signal noise

What drives a car that can drive itself? DuPont innovation.

On the autonomous road ahead, DuPont is helping catalyze a more sustainable world. With materials that vastly improve connectivity, reliability and processing speed.

Flexible laminates address flex circuits’ unique manufacturing challenges

Laminates designed for flexible substrates have numerous potential applications in consumer and industrial products

DuPont announces new product brand name - Duroptix® for LED silicone materials

Customers can continue to count on the same performance and durability of these high-performance silicone-based optical materials that they have come to trust.

Advanced polyimides for more flexible high-speed 5G networks

DuPont's Pyralux® AP with RA copper offer an ideal flexible circuit option in the race to 5G.

Low-Loss Materials Key for High-Frequency Applications

DuPont laminates meet low-loss requirements for 5G and other high-data-rate applications, including IoT and autonomous cars.

Viewpoints

DuPont: Your Ultimate Flexible Circuit Materials Partner

Developing today’s complex high-tech electronic devices requires engineers to incorporate a range of materials with unique properties designed to help enable advanced functionality.

Embedding flexibility in next-gen electronics design

Flexible printed circuit boards offer solutions for design engineers who face challenges fitting more components into smaller devices.

Miniaturization, Major Innovations Help Map the Course of Next-Gen PCBs

Innovation has no boundaries and consistently create miniaturized, extremely high-quality PCBs.

Press-fit solutions address future automotive reliability requirements

To meet reliability standards, automotive PCBs migrate to solderless press-fit interconnections.

Transitioning to chromium-free etch technology for plating on plastics

Dow reports on its progress with a plating on plastics process free from hexavalent chromium.

Autonomous cars driving next gen pcb material requirements

Why the automotive industry needs thermally stable PCB materials that withstand harsh environments.

How silver catalysts enhance PCB manufacturing

Silver catalysts provide good catalytic activity, high electrical conductivity, modest cost, and good process stability, making PCB manufacturing a candidate for use

Meeting the horizontal electroless copper plating challenge

How DuPont addresses reliability demands and increased complexity of HDI and IC package substrates.

Chromium-free etch technology for plating on plastic

How to eliminate hexavalent chromium when plating acrylonitrile butadiene styrene on plastic.

Silver Plating technology driving 200°C automotive apps

How we overcame technical challenges to develop a flexible, high-performance automotive solution.

Nickel electroplating without boric acid

To comply with EU REACH legislation, boric acid replacement electrolytes for nickel are in development, with boric acid-free nickel plating already demonstrated.

Increasing smartphone functionality through novel metallization

Finer PCB Line/Space requirements are needed to deliver performance and DuPont has the solution.

Knowledge

Copper electroplating fundamentals

This tutorial examines the concept of copper electroplating and how the process works, as well as its use in advanced packaging applications.

Examining unique TSV plating challenges

This tutorial examines the concept of copper through silicon via electroplating, which can increase reliability and decreases cost of subsequent process steps.

Cleaning up PCB final finish: cyanide-free ENIG coatings

Reliable, cyanide-free ENIG surfaces delivers low gold porosity and excellent corrosion resistance.

Copper pillar electroplating tutorial

Learn about Cu pillar requirements and processing considerations for advanced chip packaging.

Managing fan-out wafer level packaging material properties, part 2

The key structures for FOWLP and considerations for managing material properties.

Innovative advancements in automotive infotainment require superior electronic devices

How do PCB engineers fit all the necessary inputs and outputs on their boards while also ensuring reliable, long-term operation in demanding environments?

Innovation in CMP: The Ikonic™ polishing pad platform

Colin Cameron discusses DuPont's biggest CMP portfolio expansion and its value in the marketplace.

Inner-layer Copper Reliability of Electroless Copper Processes

Understanding material interactions helps PCB manufacturing control and interconnect reliability.

Flexible Circuits Increase Range and Safety for Vehicle Batteries

Increased electrification of vehicles is a growing technology trend, driven in large part by advances in lithium (Li)-ion cells and battery pack design.

Enhancing advanced PCB performance with corrosion-resistant electroless nickel

How to get excellent electrical and mechanical connections between advanced PCBs and IC packages.

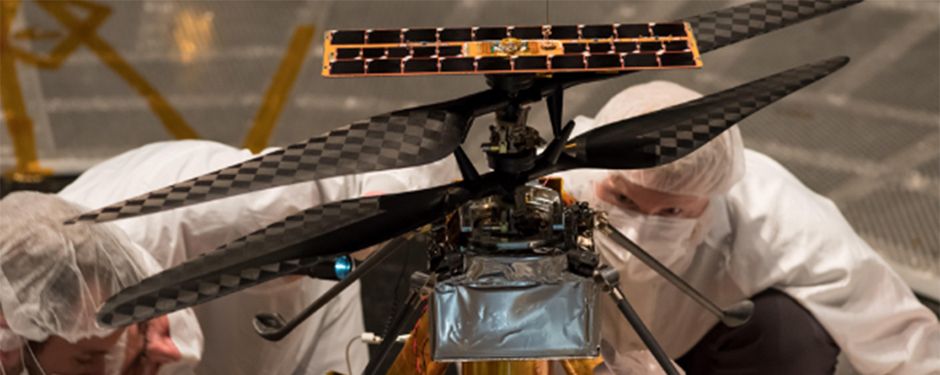

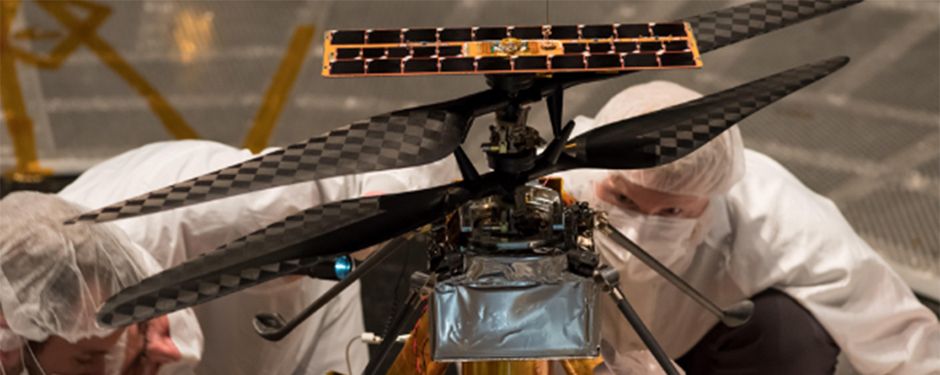

DuPont Technology Protects Ingenuity Mars Drone Mission

Ingenuity took its maiden voyage over the Martian soil on April 19, 2021.

New Kapton® Insulation Lasts Longer on High-Performance Traction Motor Conductors

Addresses the impact of higher switching frequency and faster voltage rise on motor insulation; shows eight-fold improvement over standard polyimide insulators.

Fan-out wafer-level packaging materials evolution

In the first of two parts, we examine the backstory of FOWLP and the markets it serves.

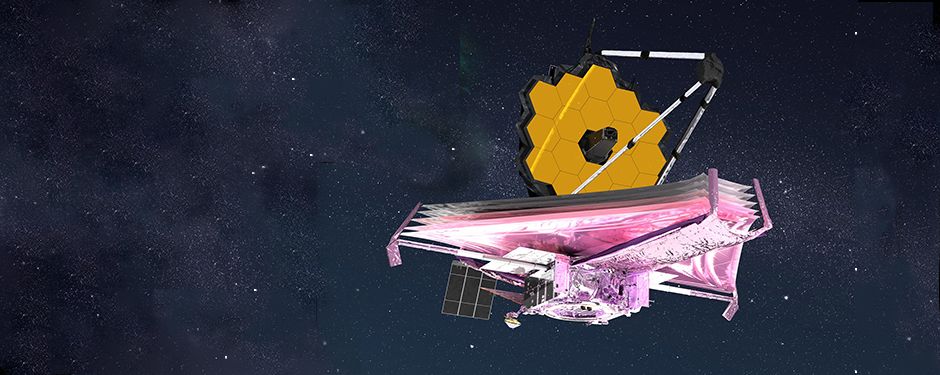

NASA’s Webb Telescope Keeping Cool with Ultra-thin DuPont™ Kapton® Polyimide Films

The excellent thermal and mechanical properties of Kapton® polyimide film make it an ideal material for space applications.

Fast, high-purity Cu plating enables next-gen devices

Copper plating forms critical connections from horizontal RDLs through vertical pillars.

Kapton® Films and Pyralux® Laminates Provide Superior Performance in Satellite/Spacecraft Applications

DuPont offers space satellite applications product selection guide to assist in the development of the next generation of space vehicles.

Inkjet printing for eco-friendly PCB etch processes

Inkjet printing improves etch capability to meet tight tolerances, complex patterns and more.

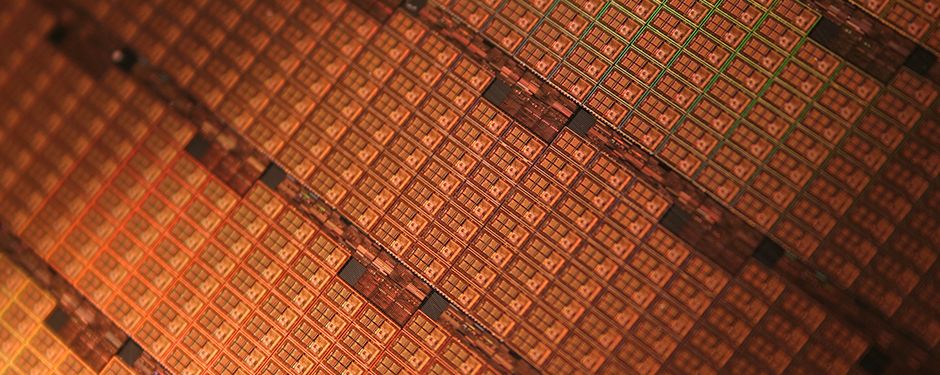

Lithographic Material Evolution Continues to Enable the Semiconductor Industry

CD scaling, 3D structures and escalating costs drive advances in lithography and enabling materials

Fine-tuning CMP slurries for 3D TSV processes

DuPont's Michelle Ho explains the role of CMP in 3D TSV processes and discusses CMP slurry design.

DuPont Solutions Are Enabling Next-Gen Automotive Electronics and Electrified Powertrain Component Innovations

Copper electroplating fundamentals

This tutorial examines the concept of copper electroplating and how the process works, as well as its use in advanced packaging applications.

Industry Engagement

Featured Solutions

ESA Mission to Explore Jupiter’s Moons Features DuPont Technology

Kapton® protects Jupiter Icy Moons Explorer by providing thermal insulation against extreme temperatures encountered during the mission.

Helping Advance DuPont’s Sustainability Commitment: PCMPSolv™ Cleaning Solutions

DuPont PCMPSolv™ family performs advanced post-CMP cleaning with safer-by-design, green chemistries.

Low-Loss Materials Key for High-Frequency Applications

DuPont laminates meet low-loss requirements for 5G and other high-data-rate applications, including IoT and autonomous cars.

Protecting Space Exploration Vehicles and Satellites

Protection of Rover’s sophisticated equipment is crucial to the overall success of the mission.

DuPont Pyralux® AP to Aid Reliable Performance of Semikron-Danfoss eMPack® Modules Powering Next-Gen Electric Vehicles

DuPont (NYSE:DD) Interconnect Solutions, part of the Electronics & Industrial business, announced today a multiyear contract with European power module manufacturer Semikron-Danfoss

Fine-Line Patterning for SLPs Calls for High-Resolution Photoresist

Product miniaturization is driving demand for substrate-like PCBs (SLPs) with finer patterns, requiring advanced photoresist materials.

Thin Laminates as Embedded Capacitance for PDN Designs

Power distribution networks provide clean power for electronics. Using thin laminates for capacitance enables lighter end products with low signal noise

What drives a car that can drive itself? DuPont innovation.

On the autonomous road ahead, DuPont is helping catalyze a more sustainable world. With materials that vastly improve connectivity, reliability and processing speed.

DuPont announces new product brand name - Duroptix® for LED silicone materials

Customers can continue to count on the same performance and durability of these high-performance silicone-based optical materials that they have come to trust.

Flexible laminates address flex circuits’ unique manufacturing challenges

Laminates designed for flexible substrates have numerous potential applications in consumer and industrial products

Advanced polyimides for more flexible high-speed 5G networks

DuPont's Pyralux® AP with RA copper offer an ideal flexible circuit option in the race to 5G.

New digital hub features DuPont’s total solutions for advanced automotive interconnects

DuPont (NYSE:DD) Interconnect Solutions, part of the Electronics & Industrial business, announced today a multiyear contract with European power module manufacturer Semikron-Danfoss who will integrate DuPont™ Pyralux® AP all-polyimide double-sided copper clad laminate into its eMPack® power modules to further enhance the capabilities of next-gen electric vehicles.

Kapton® Returns to the Moon

On November 16th, NASA successfully debuted its Space Launch System (SLS) rocket and the Orion capsule with a long-awaited launch from Kennedy Space Center, for what will be a more than month-long journey around the Moon.And as was the case for the first missions to the Moon, DuPont™ Kapton® polyimide films are onboard.

Why Select DuPont™ Kapton® Films?

For more than five decades, DuPont has been at the forefront of material science, driving innovation and technological advancement with materials that have become synonymous with high-performance, reliability, and versatility.

The biggest threat to electric vehicles – and the materials solution

Thermal runaway is a critical safety issue in electric vehicles, occurring when a battery cell experiences an uncontrollable temperature increase. Flaws in or damage to a battery can spike heat within the battery.

Advancements in Thermal Management: Material Talk With DuPont

An insightful discussion featuring Mike Kwasny, business development manager at DuPont™, delves into technologies and innovations in electronics manufacturing featuring their unique material solutions, including their Kapton® film and Pyralux® laminate lines.

The materials science backbone of AI: Challenges and opportunities

Amid the breathless speculation about their mind-boggling possibilities, advanced computing and artificial intelligence applications face consequential but little-publicized performance hurdles.

How DuPont Is Accelerating Optical Industry Innovation at its Taoyuan Site in Taiwan

In this video, Joyce Yeh, regional sales manager for silicones, discusses DuPont's enhanced and expanded Optical Silicone Lab in Taoyuan, Taiwan.

Viewpoints

DuPont: Your Ultimate Flexible Circuit Materials Partner

Developing today’s complex high-tech electronic devices requires engineers to incorporate a range of materials with unique properties designed to help enable advanced functionality.

Embedding flexibility in next-gen electronics design

Flexible printed circuit boards offer solutions for design engineers who face challenges fitting more components into smaller devices.

Miniaturization, Major Innovations Help Map the Course of Next-Gen PCBs

Innovation has no boundaries and consistently create miniaturized, extremely high-quality PCBs.

Press-fit solutions address future automotive reliability requirements

To meet reliability standards, automotive PCBs migrate to solderless press-fit interconnections.

Transitioning to chromium-free etch technology for plating on plastics

Dow reports on its progress with a plating on plastics process free from hexavalent chromium.

Autonomous cars driving next gen pcb material requirements

Why the automotive industry needs thermally stable PCB materials that withstand harsh environments.

How silver catalysts enhance PCB manufacturing

Silver catalysts provide good catalytic activity, high electrical conductivity, modest cost, and good process stability, making PCB manufacturing a candidate for use

Meeting the horizontal electroless copper plating challenge

How DuPont addresses reliability demands and increased complexity of HDI and IC package substrates.

Chromium-free etch technology for plating on plastic

How to eliminate hexavalent chromium when plating acrylonitrile butadiene styrene on plastic.

Silver Plating technology driving 200°C automotive apps

How we overcame technical challenges to develop a flexible, high-performance automotive solution.

Nickel electroplating without boric acid

To comply with EU REACH legislation, boric acid replacement electrolytes for nickel are in development, with boric acid-free nickel plating already demonstrated.

Increasing smartphone functionality through novel metallization

Finer PCB Line/Space requirements are needed to deliver performance and DuPont has the solution.

Knowledge

Copper electroplating fundamentals

This tutorial examines the concept of copper electroplating and how the process works, as well as its use in advanced packaging applications.

Examining unique TSV plating challenges

This tutorial examines the concept of copper through silicon via electroplating, which can increase reliability and decreases cost of subsequent process steps.

Cleaning up PCB final finish: cyanide-free ENIG coatings

Reliable, cyanide-free ENIG surfaces delivers low gold porosity and excellent corrosion resistance.

Copper pillar electroplating tutorial

Learn about Cu pillar requirements and processing considerations for advanced chip packaging.

Managing fan-out wafer level packaging material properties, part 2

The key structures for FOWLP and considerations for managing material properties.

Innovative advancements in automotive infotainment require superior electronic devices

How do PCB engineers fit all the necessary inputs and outputs on their boards while also ensuring reliable, long-term operation in demanding environments?

Innovation in CMP: The Ikonic™ polishing pad platform

Colin Cameron discusses DuPont's biggest CMP portfolio expansion and its value in the marketplace.

Inner-layer Copper Reliability of Electroless Copper Processes

Understanding material interactions helps PCB manufacturing control and interconnect reliability.

Flexible Circuits Increase Range and Safety for Vehicle Batteries

Increased electrification of vehicles is a growing technology trend, driven in large part by advances in lithium (Li)-ion cells and battery pack design.

Enhancing advanced PCB performance with corrosion-resistant electroless nickel

How to get excellent electrical and mechanical connections between advanced PCBs and IC packages.

DuPont Technology Protects Ingenuity Mars Drone Mission

Ingenuity took its maiden voyage over the Martian soil on April 19, 2021.

New Kapton® Insulation Lasts Longer on High-Performance Traction Motor Conductors

Addresses the impact of higher switching frequency and faster voltage rise on motor insulation; shows eight-fold improvement over standard polyimide insulators.

Fan-out wafer-level packaging materials evolution

In the first of two parts, we examine the backstory of FOWLP and the markets it serves.

NASA’s Webb Telescope Keeping Cool with Ultra-thin DuPont™ Kapton® Polyimide Films

The excellent thermal and mechanical properties of Kapton® polyimide film make it an ideal material for space applications.

Fast, high-purity Cu plating enables next-gen devices

Copper plating forms critical connections from horizontal RDLs through vertical pillars.

Kapton® Films and Pyralux® Laminates Provide Superior Performance in Satellite/Spacecraft Applications

DuPont offers space satellite applications product selection guide to assist in the development of the next generation of space vehicles.

Inkjet printing for eco-friendly PCB etch processes

Inkjet printing improves etch capability to meet tight tolerances, complex patterns and more.

Lithographic Material Evolution Continues to Enable the Semiconductor Industry

CD scaling, 3D structures and escalating costs drive advances in lithography and enabling materials

Fine-tuning CMP slurries for 3D TSV processes

DuPont's Michelle Ho explains the role of CMP in 3D TSV processes and discusses CMP slurry design.

DuPont Solutions Are Enabling Next-Gen Automotive Electronics and Electrified Powertrain Component Innovations

Copper electroplating fundamentals

This tutorial examines the concept of copper electroplating and how the process works, as well as its use in advanced packaging applications.

Industry Engagement

DuPont and CAS Host Successful Webinar on the Advancements and Challenges of AR/VR Technologies

DuPont Display Technologies hosted a webinar with Chemical Abstracts Service (CAS), a division of the American Chemical Society, to discuss AR/VR technologies in July 2023.

Join DuPont at SEMICON Taiwan 2023

Come and meet our experts at SEMICON Taiwan 2023 to discover our range of innovative solutions and experience our diverse and inclusive culture. We can't wait to see you there

Silicon valley technology center hub for collaboration

The Center fosters technology collaboration across DuPont businesses and partners in the Bay Area.

DuPont Interconnect Solutions Launches Virtual Expo

As you prepare to take on the next frontier of your industry, partner with DuPont. Let’s tackle tomorrow’s toughest challenges together.

Reddington Addresses Customers at IPC/APEX

In a presentation to customers at the DuPont booth during the Institute for Printed Circuits (IPC) APEX Exposition recently held in San Diego, CA, Erik Reddington said the company was committed to playing a role in returning printed circuit board manufacturing to the United States and Europe.

SPIE2024

SPIE Advanced Lithography & Patterning 2024

February 25 – February 29

San Jose, California

Join DuPont at IMPACT Conference Taiwan 2024

Come and meet our experts in DuPont session "Shaping Our Future with AI by Next-Gen Substrate and Packaging" at IMPACT Conference Taiwan 2024. DuPont is proud to collaborate with industry leaders to explore advanced packaging and integrated circuit material solutions for artificial intelligence.

SPIE2025

SPIE Advanced Lithography & Patterning 2025

February 23 – 27

San Jose, California

ASMC Conference

Advanced Semiconductor Manufacturing Conference (ASMC)

May 5-8, 2025

Hilton Albany, New York

We’re here to help.

We love to talk about how our electronics solutions can build business, commercialize products,

and solve the challenges of our time.

https://www.dupont.com/electronics-industrial/contact-us.html?dfp=subscribe